Become a

Power Couple

CloudSpouse makes managing your money, tasks, and goals a breeze, so you can focus on what really matters: Netflix and chill.

Latest Posts

-

Winter Storm Survival: Essential Steps to Keep Your Family Safe

Winter storms can be a fun and magical time, but they can also be a headache when it comes to grocery shopping and meal planning. However, with a little bit of preparation and planning, you can make sure you and your family stay warm, well-fed, and happy all winter long. Here are some tips for […]

-

Fighting Inflation As a Couple

Inflation can be a real pain in the wallet, but couples can fight back by using mobile apps to monitor their expenses and manage their budget. Here are 7 steps that you and your partner can take to beat inflation and improve your financial health:

-

10 Tips for Couples to Save on Groceries

Saving on groceries is a great way for couples to save money and reduce their household expenses. Here are ten tips for couples to save on groceries: By following these tips, couples can save money on groceries and reduce their household expenses.

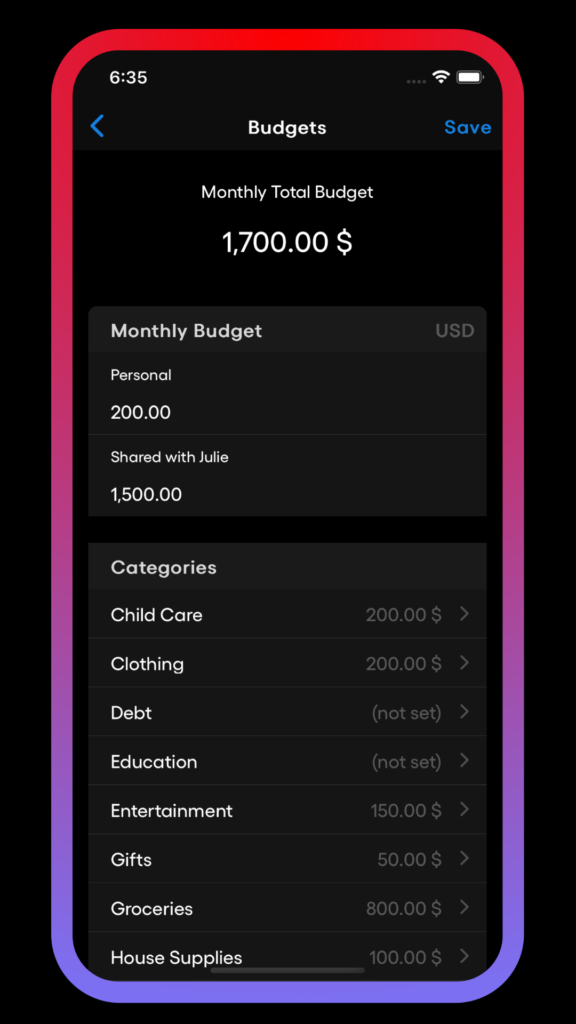

Budgets

Budgeting as a couple is the most important thing because it’s the only way to ensure that both partners are on the same page when it comes to spending and saving. Without a budget, one partner might be secretly splurging on designer handbags while the other is scrimping and saving for a rainy day.

This can lead to all sorts of problems, including fights over money and an uneven distribution of financial responsibilities. So if you want to avoid these pitfalls and keep your relationship strong, make sure to sit down with your partner and come up with a budget that works for both of you. Trust us, it’s worth it!

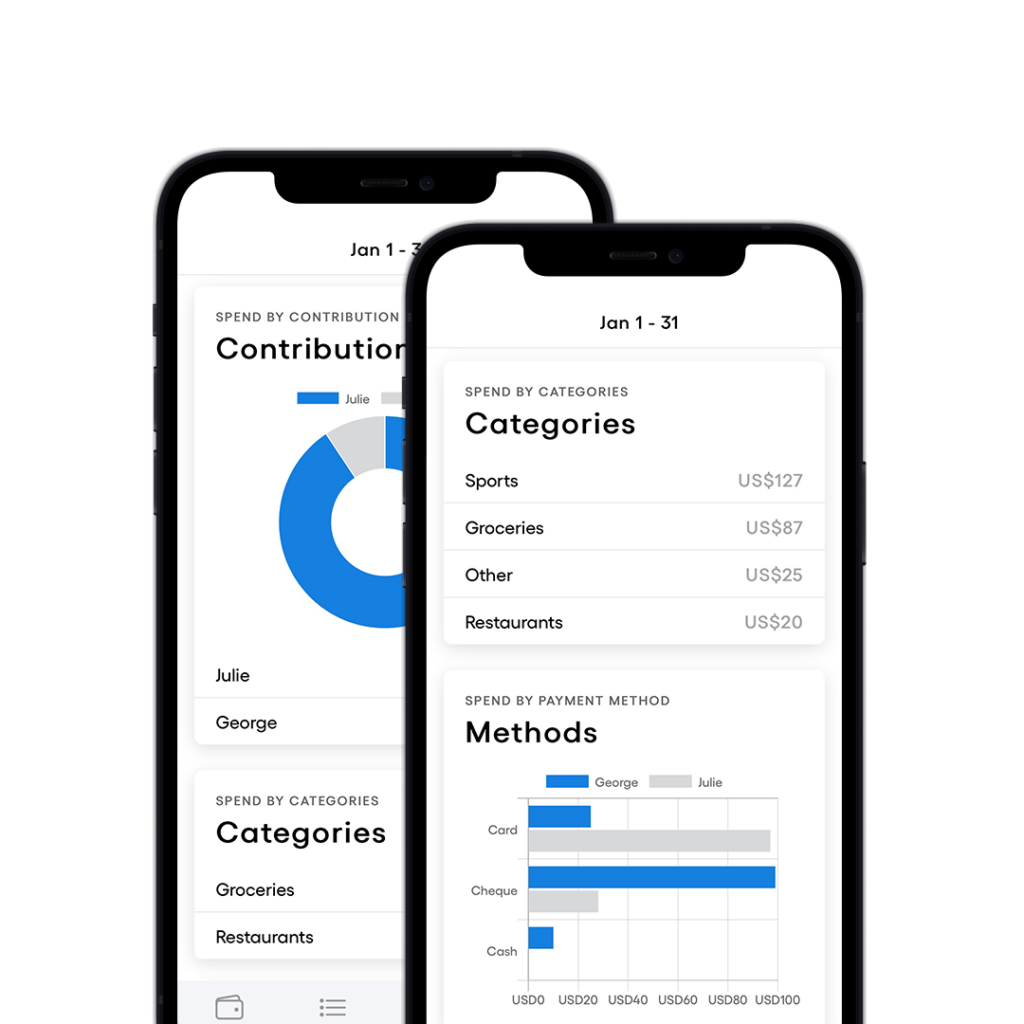

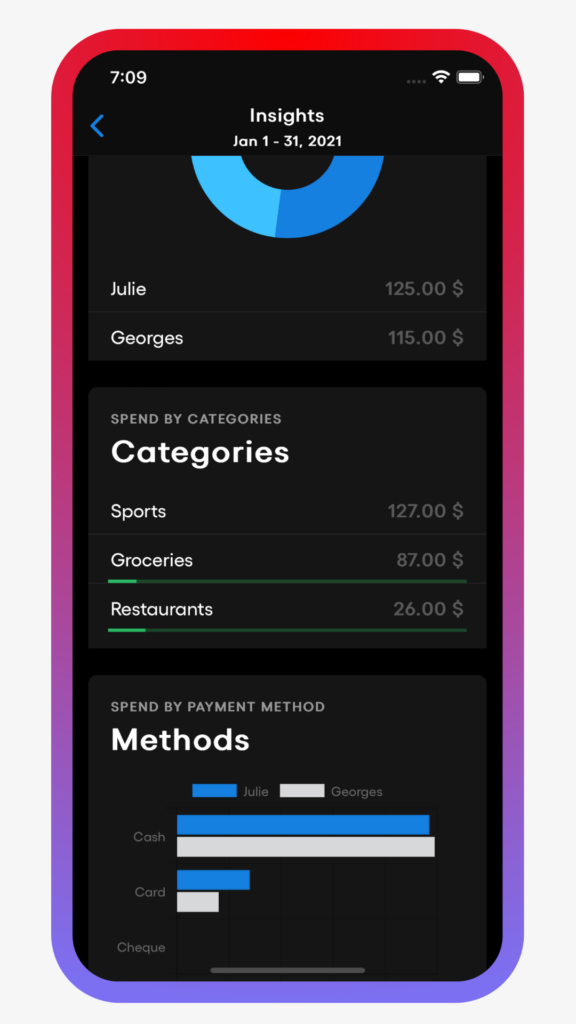

Insights

Analyzing how money is spent as a couple is important because, let’s be real, nobody wants to be that couple that constantly fights about money and ends up on the brink of divorce because one person spent $200 on avocado toast and the other person spent $50 on a pair of socks. By analyzing how money is spent, couples can avoid these types of petty arguments and instead focus on more important things.

Plus, analyzing money spending helps couples make informed financial decisions and ensures that their money is being used wisely, rather than just randomly being thrown at unnecessary purchases like a bag of potato chips that will only bring temporary happiness. So, in short, analyzing money spending as a couple is important for the sake of your relationship and your bank account.

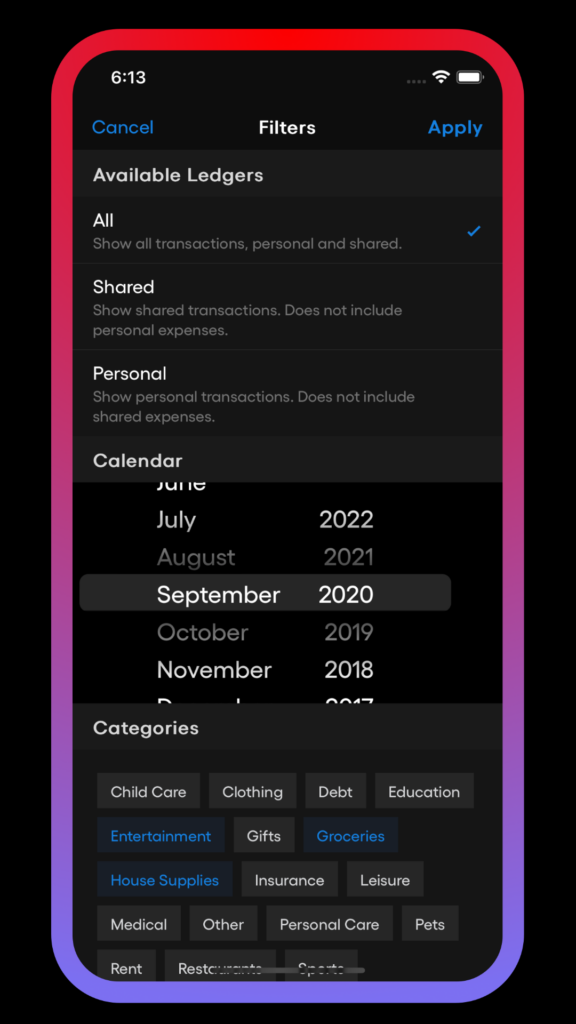

Filters

Filtering expenses is like the ultimate superpower for anyone trying to keep their finances in check. It’s like having X-ray vision for your bank account. You can see exactly where all your money is going, whether it’s on groceries, entertainment, or that one time you accidentally spent $100 on cat toys (no judgment, we’ve all been there). And with the ability to filter by category and date, you can really drill down and see where you’re spending the most.

Maybe you’ll discover that you’re splurging a little too much on takeout. Either way, having the ability to filter expenses is crucial for anyone looking to take control of their spending and save some cash. Plus, it’s way more fun than doing math by hand.

We love how user-friendly this app is. It has helped us stay on track with our finances and goals.

Julie & George

Track

Your expenses and todos.

Don’t let your spending decisions be a mystery! Start keeping track of them to develop healthy habits and gain control over your finances.

Analyze

Your behaviour and priorities.

Ever feel like your money just disappears? Start analyzing where it’s going – like that morning coffee habit that’s draining your bank account.

Execute

Your plan and achieve your goals.

Make smart choices based on careful consideration and analysis. Otherwise, you’ll end up regretting that impulsive, last-minute donut purchase.

Couples who work together,

stay together